Wells Fargo Grants Support Small Business, Tax Preparation Programs

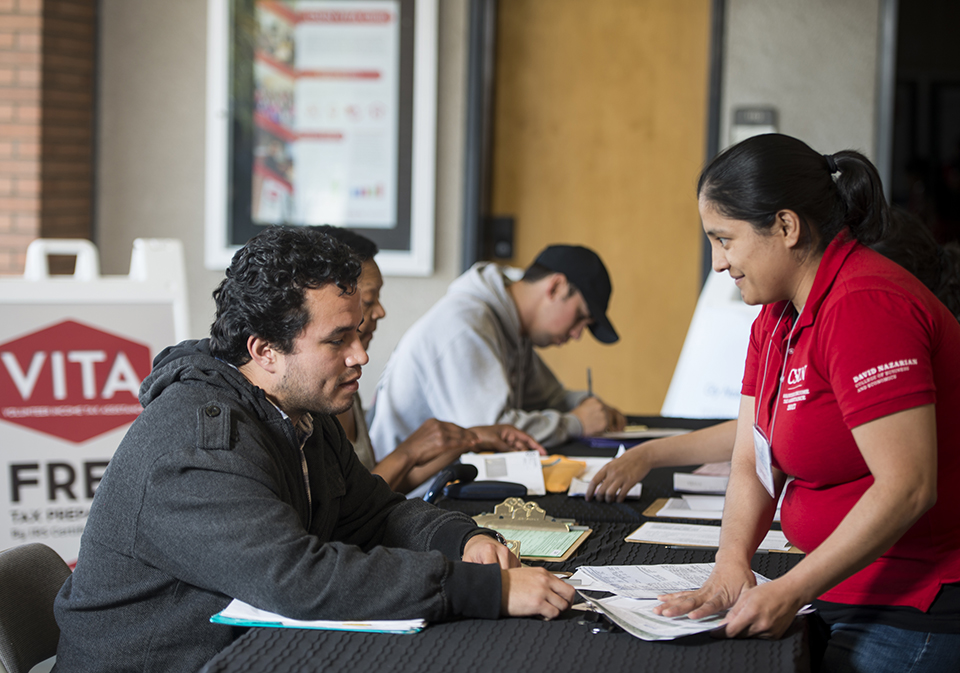

A VITA student volunteer provides in-person assistance to a taxpayer. The Wells Fargo Foundation has awarded CSUN two grants totaling $250,000 to support VITA and the Nazarian College Small Business Consulting Program. Photo by CSUN photographer.

The Wells Fargo Foundation has awarded California State University, Northridge two grants totaling $250,000 to support the university’s free tax-preparation program for low-income individuals and families, and a program supporting small business consulting in the David Nazarian College of Business and Economics.

The multi-year commitment will support the expansion of CSUN’s Volunteer Income Tax Assistance (VITA) Clinic to serve low-income taxpayers throughout Los Angeles County, as well as continue support for the Nazarian College Small Business Consulting Program, through which students provide consulting services — including marketing, expansion plans and long-range planning — to dozens of small businesses each year.

“Wells Fargo Bank’s support of the CSUN VITA Clinic and the Small Business Consulting Program has been critical to their success and our ability to expand our reach throughout the region,” said Chandra Subramaniam, dean of the Nazarian College. “The benefits are numerous. Not only are we able to provide free tax-preparation services to low-income individuals, which results in millions of tax-refund dollars being funneled back in our community, but we provide our students with some real-world experience, get them ready for the world of work, and instill a philosophy of giving back to the communities from which they come.”

Wells Fargo officials said they were happy to support the CSUN VITA Clinic and the Small Business Consulting Program.

“We understand the significant impact that the VITA program has had within the San Fernando Valley community,” said Jack Olree, Wells Fargo Southern California vice president for social impact. “We are excited that our ongoing support will help expand the program to all of Los Angeles County CSUs.”

Wells Fargo’s $200,000 grant to the VITA Clinic will launch a hybrid in-person and virtual platform to scale up free tax-preparation services throughout Los Angeles County.

Powered by nearly 850 student volunteers by 2024, and in partnership with four other California State Universities in the Los Angeles area — Dominguez Hills, Long Beach, Los Angeles and Pomona — as well as numerous community organizations, the CSUN VITA Clinic is expected to serve as many as 15,000 low-income and underserved minority residents of Los Angeles.

Clinic officials anticipate generating more than $19 million in tax refunds and $7.5 million in tax credits, while saving taxpayers more than $3.3 million in tax-preparation fees.

In addition, more than 400 low-income taxpayers will receive one-on-one free financial coaching services from certified student financial coaches. During those session, taxpayers will be able to develop a customized budget, develop a strategy to pay down debt, or save for a new home, college or retirement.

Wells Fargo’s $50,000 grant to the Nazarian College Small Business Consulting Program is designed to provide support to small businesses as they recover from the impact of the COVID-19 pandemic.

During the 2022-23 academic year, the program will support 30 small businesses, including several micro businesses with whose annual revenue has dropped below the program’s threshold of $100,000, with the goal of supporting their revenue recovery.

The program pairs three to five Nazarian College students with small businesses seeking analysis and recommendations to meet a specific challenge. Challenges can range from marketing and business expansion and development to long-range planning, cash management and budgeting.

The student consultants meet with their clients to review goals and financial statements, visit business locations, evaluate and develop strategies. By the end of the semester, each consulting team will have dedicated more than 200 hours to each project and developed a comprehensive report detailing their findings and recommendations.

experience

experience