CSUN Students Beat the Markets in Managing CSUN’s Portfolio

Senior economics major Idean Aminian demonstrating a concept to students in the Student Portfolio Seminar. Students taking the seminar regularly beat finance professionals in managing the university’s portfolios. Photo by David Hawkins.

Using the latest investment software, intense research and hours spent on targeted analysis of the financial markets, the students in California State University, Northridge Finance 491A and 491B: Student Portfolio Seminar are outperforming finance professionals and turning nearly $5 million of investments into scholarships, research and other opportunities for the university.

“It’s not easy,” said finance professor Mike Phillips, who teaches the seminar. “It’s a lot of hard work, probably some of the hardest work they have ever done, but they are doing it. They are making money for the university.”

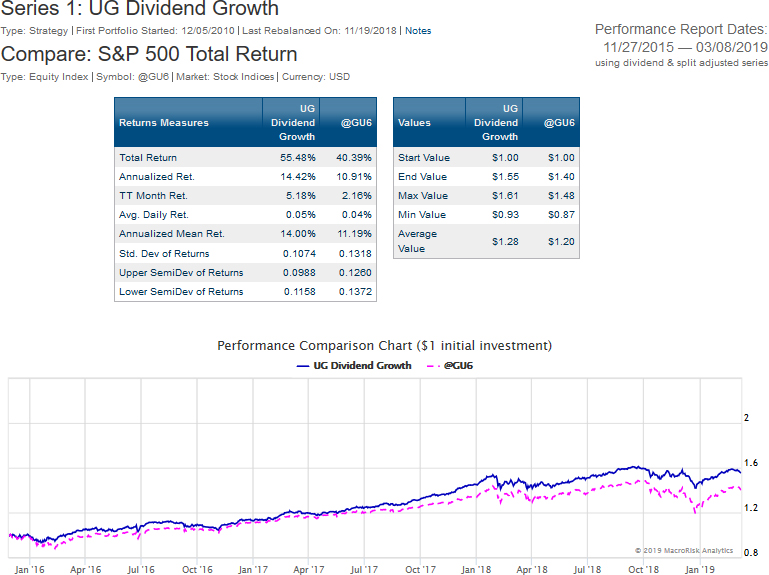

From fall 2015, to present, the dividend portfolio has grown from $2,151,315 to $3,297,801, an annualized return of about 14 percent compared to the benchmark return of about 11 percent per year. The “return per unit volatility,” a common measure to see whether investments are gaining return by making investments that are too risky, is about 1.34 for the student portfolio compared to 0.83 for the benchmark. CSUN earned almost $323,000 more on the student-managed portfolio invested in relatively safer assets than the portfolio would have received with the average market return.

When the first investment class met in 1993, the students were allocated $500,000 by The University Corporation, a CSUN auxiliary, to invest with the goal of providing a real-world context for what the students were learning in class. Despite the economic downturn at the time, the students’ investment portfolio beat Standard & Poor’s 500, a financial index, and earned a small profit for the university.

Over the years, the single class has grown into a two-class seminar, and the amount of money the students handle also has grown. They now manage about $5 million, with about $3.5 million from The University Corporation, and the rest from the CSUN Foundation, the nonprofit fundraising arm of the university. Their investments, and the two classes, are divided between two portfolios, stocks and exchange-traded funds (ETFs).

The only thing that hasn’t changed is that the students continue to regularly outperform Standard & Poor’s and other financial indexes.

“The students consistently have portfolios with safer and higher returns than the corresponding benchmark,” Phillips said. “Part of this is because the students take the time to do all the steps and follow a very structured process so they are not plagued by emotions.”

Robert Gunsalus, CSUN’s vice president for university advancement and president of the CSUN Foundation, and Rick Evans, executive director of The University Corporation, said they were impressed with the students’ investment acumen.

“The students have a high level of accountability, and they are adding value to the portfolio” Gunsalus said. “It is also a great educational experience for the students and they get the opportunity to network with members of the foundation’s finance committee, all of whom are leaders in their fields and really enjoy interacting with such promising young people.”

Evans said that the corporation could not be more pleased with the students’ investment performance.

“For years, finance students have managed a significant portion of the corporation’s investment portfolio, and they have consistently outperformed comparative market indexes,” he said. “CSUN’s student investment funds were groundbreaking, and have over the years served as models for other campuses.”

When the investment class was introduced 26 years ago, Phillips, who helped originate the class, said only a handful of universities and colleges across the country offered similar classes. While no longer the case anymore, CSUN’s portfolio seminar still stands out.

Finance professor Mike Phillips in class. Photo by David Hawkins,

“While there are several hundred colleges with students who manage investment funds today,” he said, “very few of them are managed from a portfolio perspective, and very few of them have the potential for complexity that we do, given the size of the investment tool available.”

In 2015, one of the computer labs in CSUN’s David Nazarian College of Business and Economics was turned into an investment laboratory and classroom, in essence a “trading room,” with the support of donors. Computer stations were equipped with software and databases found at major investment firms. Students have the ability to project or share what they see on their screens with their colleagues, encouraging serious and thoughtful discussions about where to invest CSUN’s money.

Phillips noted that there are some restrictions on where the students can put the university’s money based on the institution’s mission and values.

“We cannot invest in tobacco or smoking-related products, gambling, private jails, handguns or sexually exploitative industries,” he said. “Even with those restrictions, our students do well.”

The goal, he said, is not to make dramatic investments that shake up the portfolios, but rather investments that ensure steady growth and returns. Phillips noted that the class is open to all disciplines, not just finance majors.

“Most of the students have a wide variety of backgrounds,” he said. “Yes, some are finance, economic or accounting majors. But others have been engineering and math majors. The class is open to students across the campus.”

Finance and business management major Miranda Hanzlik, who took Finance 491A last semester and is now in Finance 491B, said that diversity of perspectives is an asset as the students analyze when to invest the university’s money.

“When you are weighing investments, it’s really important to consider differing perspectives before you make a decision,” said Hanzlik, a senior. “When you are majoring in business, you tend to find your classmates can share many of your perspectives. After all, you are studying similar topics. But when someone from a different major — whether it’s psychology or math or engineering — from outside the college offers their perspective on a potential investment, it’s an important addition to the discussion.”

Senior economics major Idean Aminian said the students in the portfolio seminar take their responsibilities seriously.

“We understand that this class has a bigger purpose, one that is greater than us,” said Aminian, who took both classes and serves as a teacher’s assistant for the seminar. “The conflicts that might arise when you are working in groups don’t really happen in this class. We have to do our research, listen to each other and respect each other’s ideas because there’s too much at stake. What we are doing provides supports for research, scholarships and other opportunities for our fellow students. That is more than just a class or a grade.”

experience

experience